2025 Market Report of Marbella Real Estate

KEYS AND CHALLENGES TO MAINTAIN THE GOOD HEALTH OF THE PREMIUM REAL ESTATE MARKET

As we step into 2025, The Agency Marbella – Belleside Real Estate has launched an in-depth analysis of the Costa del Sol’s luxury residential market, offering a comprehensive overview for industry professionals. This Luxury Residential Market Report delves into the keys to sustaining the sector’s robust performance while addressing emerging challenges and opportunities.

The Costa del Sol remains a cornerstone of Spain’s luxury real estate landscape, renowned for its unique combination of world-class lifestyle offerings, exceptional architecture, and a climate unmatched in Europe. As prices continue their upward trajectory and demand evolves, understanding this dynamic market is essential for investors, developers, and agents alike.

According to Leif Orthmann, Managing Partner at The Agency Marbella, “We are experiencing a golden age in luxury real estate. International buyers increasingly recognize the Costa del Sol as not just a safe investment but an unparalleled place to live.” However, Orthmann and other experts emphasize that while the market offers significant opportunities, it also faces challenges that require strategic insight and adaptability.

This report provides a detailed examination of current trends, the profile of high-end buyers, and market projections for 2025, equipping stakeholders with the tools needed to thrive in this ever-evolving premium real estate sector.

Read our 2024 Market Report

- Table of contents

- 01. Client profile in the luxury market

- 02. Price evolution and trends in luxury residential housing

- 03. Development and consolidation of branded residences.

- 04. Sustainability and efficiency

- 05. X-Ray of the luxury residential market in marbella and costa del sol

- 06. Main challenges and opportunities for the luxury residential segment in Marbella and Costa del Sol

- 07. Tourist accommodations on the costa del sol

- 08. Analysis of housing in Spain and internationally according to the Bank of Spain

Click here to download 2025 Market Report

01. Client profile in the luxury market

Buyers of luxury properties in Spain and the Costa del Sol are divided into two main demographic groups:

On the one hand, there are the senior buyers, mostly over 50 years old, professionals in advanced stages of their careers or retired. This group especially values security, exclusivity and quality, looking for properties that offer a high level of comfort and privacy. Many of them acquire these properties as second homes or as homes for their children while they study or work in cities such as Madrid or Barcelona.

On the other hand, the market also attracts younger professionals, entrepreneurs and families in their 30s and 40s. This group is looking for modern homes, with a strong focus on design and technology. They also value sustainability and energy efficiency, in line with a global trend towards a more conscious and environmentally friendly lifestyle.

Foreign buyers remain an important part of the market, especially from Northern Europe (Germany, UK, France), the United States and Canada, and to a lesser extent, Latin America (Mexico, Venezuela, Colombia). In particular, the Balearics and Marbella are hot spots for US investors, who value lifestyle, security and international connections. These buyers tend to choose properties not only to enjoy as holiday homes, but are also looking for secure investments in areas with high appreciation potential.

Foreign buyer motivations

Motivations for investing in the luxury residential market are diverse and center on several key factors:

- Investment Diversification and Security: luxury properties are seen as secure investments that appeal to both buyers seeking primary residences in cities such as Madrid and Barcelona, as well as those desiring second homes on coasts such as Malaga and Mallorca.

- Privacy and Security: Privacy and security continue to be a priority, with advanced systems and architecture designed to protect residents and their families.

- Lifestyle: Spain stands out for its extensive leisure offerings geared towards the luxury segment, combining a vibrant culture and exceptional amenities. Residents enjoy the freedom to choose between an exclusive social life, surrounded by like-minded people, or a more discreet and tranquil experience. The possibility of access to a luxurious and active lifestyle coexists with the option to lead a low profile and simpler life if preferred, all within a warm climate environment that allows for a perfect balance between activity and privacy.

- Residential Use and Investment: There has been an increase in the purchase of luxury homes as investments in areas such as Madrid, in addition to the interest in residential use. This reflects the perception of these properties not only as homes but also as stable assets that offer financial returns in a secure environment.

02. Price evolution and trends in luxury residential housing

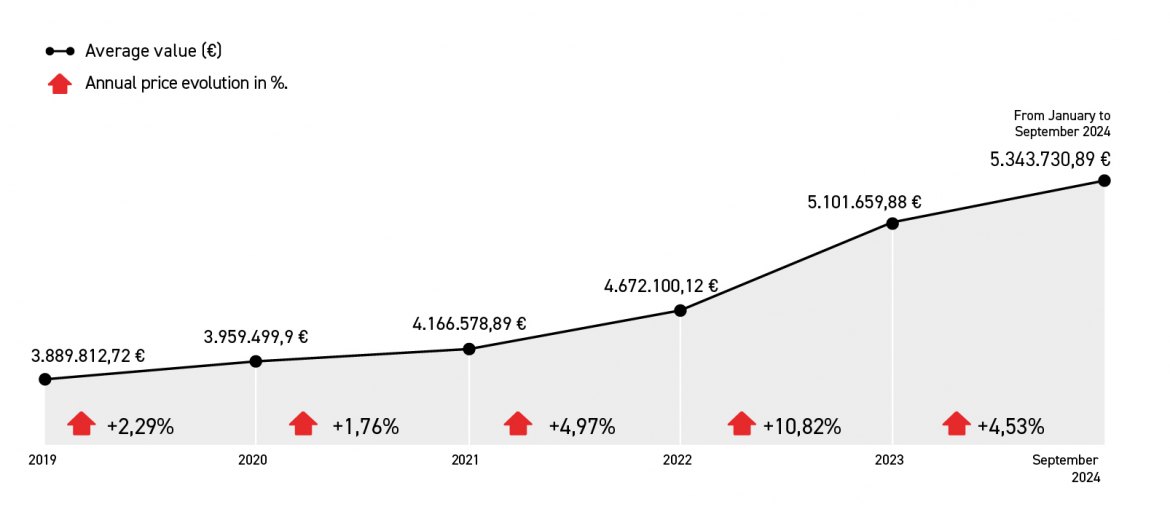

According to the data analyzed by Tecnitasa’s Report on the evolution and trends of the luxury residential market in Spain 2024, we can see that the average prices of luxury homes (over 3 million euros) have experienced a year-on-year growth of 4.53% in 2024 throughout Spain. Alicante, with an increase of 9.60% compared to last year, has been the area where the value of housing has increased the most, since it started from more affordable prices than other areas. Barcelona and Madrid stand out at the top, with increases of 7.73% and 7.48% respectively. Baleares, Malaga – Costa del Sol have rises with increases of 3.62 and 3.17 percent.

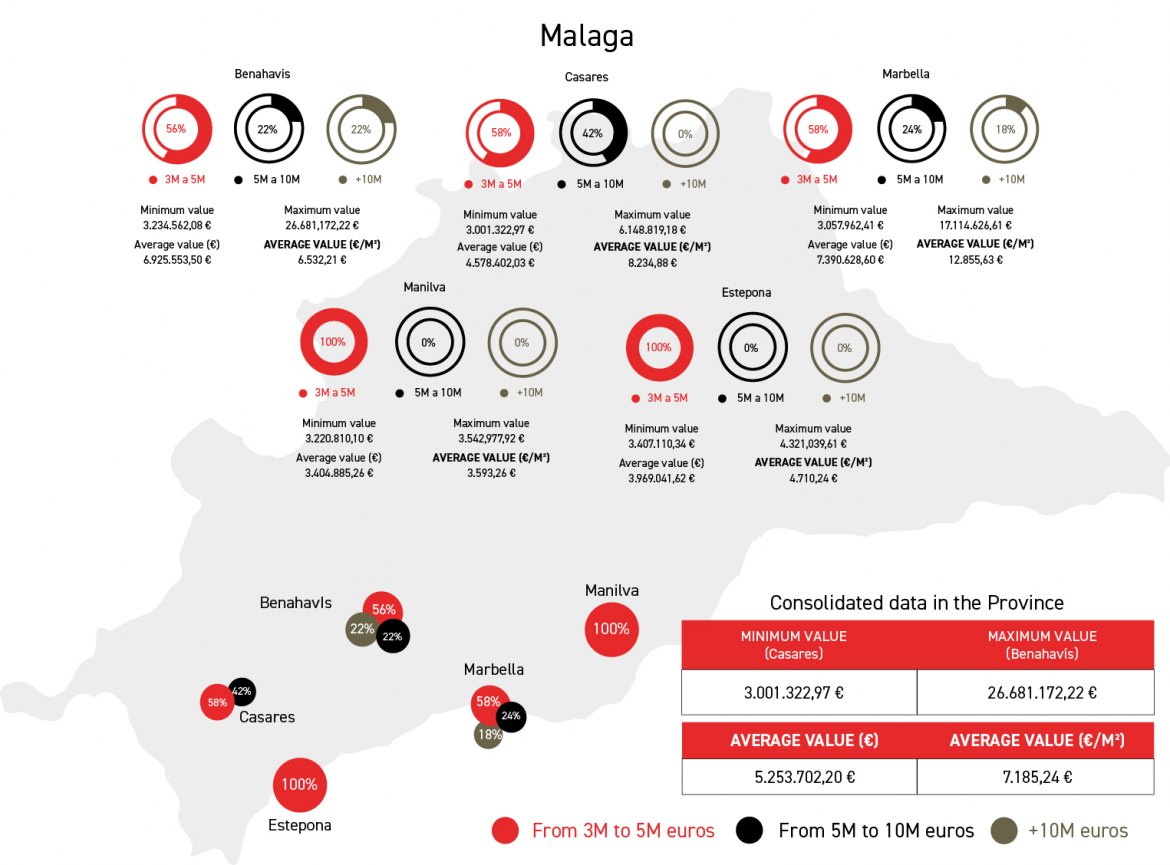

Specifically, the evolution of prices in the luxury market in Costa del Sol La Costa del Sol, for homes over 3 million euros presents a growth of 3.17%. The minimum value registered is in Casares with a value of 3,001,322.97 €, while the highest value is in Benahavís, which registers a price of 26,681,172.22 €. The average value of luxury properties in the province is 5,253,702.20 €, with an average value per square meter of 7,185.24 €/m2.

In 2024, the luxury residential market in Spain continues to evolve, standing out not only for its adaptability to the demands of an increasingly informed and diverse public, but also for a growing trend towards decentralization due to the shortage of supply in traditional areas. This demand is driving the luxury segment in other emerging areas such as the province of Alicante, which is undoubtedly one of the fastest growing luxury destinations.

However, traditional coastal destinations such as Marbella and the Balearic Islands continue to be preferred for their climate, infrastructure and luxurious lifestyle.

03. Development and consolidation of branded residences.

In 2024, the luxury residential market has seen a significant evolution towards the integration of premium amenities and the development of “Branded Residences”. These trends reflect the growing demand for living experiences that combine luxury, comfort and exclusivity, with the hallmarks of world-renowned brands.

Branded Residences represent a symbiosis between luxury property developers and prestige brands. These properties not only carry the name of a brand, but are designed and managed according to the standards of luxury and service that the brand represents.

Marbella has established itself as a focal point for Branded Residences developments, hosting a wide variety of luxury branded projects. The offer in this area stands out for combining design, exclusivity, and premium services, with examples such as:

- Design Hills by Dolce & Gabbana: a luxury complex that includes residences decorated with exclusive pieces by Dolce & Gabbana Casa.

- Tierra Viva by DarGlobal & Lamborghini: an innovative development of villas with design inspired by the Lamborghini brand, expected to be completed in 2027.

- Epic Marbella by Fendi: a project that includes apartments and penthouses with exclusive Fendi brand design and amenities.

- Karl Lagerfeld Villas: five super-luxury villas in Marbella that combine the German designer’s aesthetic with a focus on sustainability and personalized design.serve housing accessibility for all citizens.

04. Sustainability and efficiency

Sustainability and energy efficiency have become key elements in the luxury housing market, and their presence is driving innovation and the development of new niches in this segment. Today, sustainability is not only a regulatory requirement, but is being used strategically as a driver of growth and value creation. Luxury buyers are looking for properties that offer a balance between comfort, luxury, ecological responsibility and efficiency.

Environmental certifications such as LEED or BREEAM are increasingly sought after by luxury homebuyers, as they provide a framework for evaluating a property’s sustainability. These certifications ensure that homes not only meet the most stringent environmental standards, but also deliver improved performance over time, resulting in significant savings and better resale value.

In addition, given the growing focus on sustainability among luxury consumers, these properties tend to hold their value better and be more attractive in the real estate market.

In fact, according to Wouter Draijer, CEO and founder of solar panel company Solarmente, “Clean energy properties could increase in value by 10% to 20% over the next decade.” Draijer believes that the real estate sector has a key role to play in the energy transition, as buildings account for approximately 40% of energy consumption and a third of global Co2 emissions. If we are to meet sustainability goals and reduce our dependence on fossil fuels, real estate must lead with a focus on energy efficiency and the adoption of renewable energy.

In fact, Solarmente’s founder believes that the residential sector is the one that has been betting the most on photovoltaics, especially among single-family homeowners and new developments. Housing developers are seeing an increase in consumer demand for homes with pre-installed solar installations.

On the other hand, a clear example of the integration of sustainability and luxury can be seen at La Reserva Club Sotogrande. This luxury enclave has demonstrated that it is possible to combine exclusivity with a solid commitment to sustainability. La Reserva Club has developed projects such as Villa Noon, one of the first villas in Spain to achieve zero electricity and water consumption, and has focused on the conservation of local biodiversity. In addition, the club’s golf course is GEO certified, which guarantees an environmental approach that includes minimal use of chemicals and an irrigation system based on rainwater harvesting.

05. X-Ray of the luxury residential market in marbella and costa del sol

All Spanish luxury destinations have a privileged climate, but the case of Marbella is special. The orography of the city, with access to the sea but conveniently sheltered by the mountains, gives it an extremely mild microclimate that makes it enjoyable much longer than other places. If the average stay in other luxury locations is 2 months, the mild springs and autumns of Marbella make the stay extend up to half a year. Its exquisite and exclusive leisure and shopping offer for luxury, which has been developed over decades of prosperity, the spectacular beaches, the marina, the strategic location, the excellent air communications and the high gastronomy are just some of the factors that make Marbella a unique place for luxury clients of all types.

What distinguishes Marbella and Costa del Sol from other premium destinations:

- Proliferation of branded residences: Marbella and the Golden Triangle in general (composed of Marbella, Benahavís and Estepona) is, without a doubt, the area of Spain where more branded residences projects are being concentrated. In addition to the quantity, it is the only area where we can find projects that go beyond the branded residences managed by luxury hotel chains. Fashion brands such as Fendi, Karl Lagerfeld, Dolce & Gabbana, Versace or Elie Saab already have Branded Residences projects in the capital of Marbella and Costa del Sol; also the automotive brand Lamborghini has developed a project, in this case in Benahavís. The Golden Triangle is, for the moment, the only area that allows experimentation and success with this type of transgressive projects and astronomical prices that, although they may seem risky, are backed by excellent sales data.

- Generation Z: People under 30 years of age are one of the niche markets that is having the hardest time reaching in the luxury sector, and Marbella is not only succeeding: it is one of their preferred destinations. The exclusive leisure offer in Marbella and the high technology and design of its luxury villas have attracted this new public, which includes soccer players, artists, video game creators and successful young entrepreneurs, among others. Marbella is a destination with a vibrant leisure offer, where the most important personalities gather to enjoy themselves and where being seen is also a status symbol.

- Leadership in luxury-oriented services: The evolution of the luxury sector is closely linked to the amount of services and amenities. And, therefore, companies such as Sierra Blanca Estates, in addition to leading branded residences projects, are launching luxury developments in which in addition to spectacular location, quality and design, this factor is key.

Buyer typology

The luxury buyer typology is very varied and has diversified greatly in recent years, attracting all types of audiences: from millionaires to successful European entrepreneurs of all ages. It has always been a highly coveted destination for European buyers, as well as large fortunes from the Middle East because of its good relations with the Spanish monarchy. It is also one of the places of choice for a large part of the national socialite, as well as for elite sportsmen, artists and celebrities of all kinds at international level.

The number of famous personalities in the city makes their presence normalized and certainly goes unnoticed, although, if they wish, they have private and exclusive spaces everywhere that only they can access. As far as nationalities are concerned, since the beginning of the war in Ukraine, the Russian public has declined significantly: instead, a new typology of client from Eastern Europe has appeared. Customers from Nordic countries are also very present, as well as the American public, whose entry is recent but is being very prominent.

What are the characteristics of the homes demanded by this type of clientele?

The design of luxury developments is clearly modern, minimalist and with very exclusive materials, such as Italian marble, private panoramic elevators, private pools with counter-current swimming systems or saunas overlooking the sea. It is also key to have a design by well-known architects and interior design by renowned firms or luxury fashion brands, such as Fendi Casa.

If there is one thing that makes Marbella luxury villas stand out, it is their exquisite combination of design and technology. The residences stand out for an aesthetic that knows how to differentiate itself through unique decorative pieces and art, in addition to sustainability and technology that incorporates apps and home automation to take personalization to another level, allowing owners to have control of a large number of aspects related to their home even remotely. This technology and practicality can be seen in elements such as lift-and-slide windows, double glazing with solar control coating, advanced KNX home automation systems from ABB, and blinds and air conditioning integrated into the ceiling.

In terms of quality, very exclusive natural materials have been chosen, mostly from Italy, with Carrara, Pinta Verde and Api marble from firms such as Caesar Comblanchein and Grigio Amani, premium woodwork by Schüco and kitchens by Aster, among others. Most of the properties that are being sold at the moment, due to the pressing shortage of supply, are located in the foothills of the mountain, a privileged environment that offers exclusivity and panoramic views with the sea as a highlight. The average plot size of the villas is 7.000m2 to guarantee privacy and a great amplitude of the different spaces and green areas.

Which areas of Marbella and Costa del Sol are the main ones in the luxury segment?

The lack of availability in this area has resulted in many developments moving to areas such as Sierra Blanca, located in the mountains, which offers privacy, tranquility and panoramic views, as well as Cascada de Camoján, also located at the foot of La Concha mountain in an incomparable natural setting. The urbanization of La Zagaleta, one of the most exclusive in Europe and in which there are filters to enter by the community, is also located in the mountains and has panoramic views.

The high occupancy and scarce supply of Marbella has as a result that luxury is moving to other locations such as Ojen, a dormitory town next to the capital of Marbella. Benahavís and Estepona are also receiving many clients from the luxury segment thanks to their proximity to Marbella and their good connections, despite not having such an extensive range of services. Finally, we must not forget Malaga city, which has undergone a spectacular urban transformation in recent years. Although the luxury segment is still a minority compared to other locations on the Costa del Sol, there are already developers carrying out large-scale projects. A good example is the penthouses of the Sierra Blanca Tower, a project of Sierra Blanca Estates that aims to become the benchmark for the highest standard of luxury and quality in the capital. The two units, which are located on Paseo Antonio Banderas at a height of 80m and have a surface area of 500 m2, are on sale for 9,750,000€.

06. Main challenges and opportunities for the luxury residential segment in Marbella and Costa del Sol

The Costa del Sol’s luxury residential market faces a pivotal moment, balancing exceptional opportunities with pressing challenges. While global investors are drawn to its unmatched lifestyle and premium properties, the region grapples with a severe shortage of available land, bureaucratic inefficiencies, and inadequate infrastructure. As Benjamin Beza, Director of Sales at The Agency Marbella, notes, “bureaucratic obstacles often deter investors eager to develop here.” Coupled with the high demand for exclusive, sustainable, and customized homes, these factors intensify the need for innovative solutions. Despite these hurdles, Málaga’s urban transformation and the rise of luxury services present promising opportunities for growth in one of Europe’s most coveted real estate markets.

Shortage of supply

The main challenge is the lack of residential supply in all segments. The bureaucratic hurdles and lack of land is dramatic throughout the city, in contrast to the robust demand. In this regard, the Director of Sales of The Agency Marbella, Benjamín Beza, stresses “the need for the various public administrations to facilitate the procedures so that developers can carry out more real estate developments. There is a lot of land available in magnificent locations but many times the bureaucratic obstacles put back investors who come to the Costa del Sol to invest”.

The production of luxury housing faces several challenges, such as the scarcity of available land in prime locations, restrictive zoning regulations and the complexity of obtaining building permits. Most of these properties require unique locations, spectacular views and access to exclusive services, factors that limit the number of projects that can be carried out at the same time.

Another challenge to be taken into account as a consequence of the growing demand for luxury housing is the scarce production of properties that meet the high standards of the segment. The exclusive features and level of customization demanded by luxury buyers make the construction of these homes a longer and more costly process than that of a conventional home, resulting in a limited supply in the face of increasing demand.

Transport infrastructure in Marbella

Although the international connections provided by Malaga airport are excellent, Marbella’s own connections with its metropolitan area and province have a lot of room for improvement. At present, there is no rail, streetcar or metro network to facilitate mobility, leaving the freeway and a national highway as the only means of transport, which produces huge daily traffic jams for all those who want to access their jobs.

Lack of qualified talent

The difficulty of transportation coupled with the lack of affordable housing for the local public makes it very difficult to attract qualified talent for companies that provide services to the luxury sector. It is extremely difficult to retain a professional who lives more than 30 minutes away from Marbella because of the time he or she will spend commuting to work each day, and it is even more difficult to find housing in the city. Without a doubt, there is an urgent need for a government plan to boost affordable housing in the area and allow for a sustainable ecosystem in which the local and luxury public can coexist and continue to grow.

One of the main challenges of the luxury market in Spain and the Costa del Sol is the lack of skilled labor. The construction and maintenance of luxury properties requires a range of specialized skills and knowledge beyond those found in the real estate sector: exceptional quality, perfect finishes and attention to detail are required. This ranges from luxury architects and designers to craftsmen and suppliers of exclusive materials, as well as property service and maintenance professionals who understand the expectations and standards of high-end buyers.

The development of the luxury segment in Malaga capital

The authentic revolution that Malaga is experiencing, coupled with the recent development of very attractive luxury projects, is presented as an absolute opportunity to create not only residential projects, but an entire offer dedicated to luxury.

In this sense, it must be taken into account that the luxury residential market is not only composed of exclusive properties, but also of services and personalized experiences that enrich this lifestyle. This opens up a significant opportunity for the professionalization of luxury-oriented services, ranging from property management and concierge to high-end transportation, private chefs, and health and wellness services.

07. Tourist accommodations on the costa del sol

The municipality of Marbella has surpassed the capital of Malaga in both density and number of registered tourist accommodations. With a total of 13,532 properties registered in the Tourism Register of Andalusia (RTA), Marbella has 1,400 more tourist rental properties than the city of Malaga, which has 12,099. This phenomenon has a significant impact on the local housing market, as 60% of rentals in Marbella are designated for vacation use.

Along with the city of Elche in Alicante, Marbella is one of the areas with the highest proportion of vacation rentals relative to the total number of properties. According to a report from the Bank of Spain, vacation rentals account for more than 60% of the rental stock in both locations, surpassing other renowned tourist cities like Madrid and Barcelona by several points. This expansion in the vacation rental market has intensified pressure on access to long-term housing.

Data shows that Marbella, despite its smaller size, leads the tourist housing market in Andalusia. The city’s historic center alone houses nearly a thousand tourist accommodations (916 units), while other areas, such as Ricardo Soriano and Ramón y Cajal avenues, also concentrate a significant volume.

According to the Andalusian Association of Professionals in Tourist Housing and Apartments (AVVA PRO), tourist rentals in Marbella’s historic center account for 6.7% of all registered properties. Juan Cubo, president of AVVA PRO, asserts that these properties are typically second homes that would remain empty without the option for tourist use. Furthermore, Cubo argues that the economic impact of these properties is positive for the local economy, as visitor spending contributes to local businesses and promotes year-round tourism in Marbella, particularly in landmark areas like Puerto Banús.

However, as these tourist accommodations gain popularity, so too does the controversy over their influence on residential housing availability. Cubo maintains that property owners have the right to rent their properties in the most profitable or secure way, a stance supported by the growth of the vacation rental market across the region. “The claim that the housing shortage is due to tourism is a way to manipulate public opinion,” says Cubo, accusing authorities of a lack of planning and foresight in this sector.

The authorities’ response and an ongoing study

In response to the growing demand to regulate the tourist accommodation market, the Marbella City Council has taken steps to study and assess the current situation of the tourist housing market. Ángeles Muñoz, mayor of the city, has announced a new study in collaboration with the University of Málaga (UMA) that will update a previous analysis carried out in 2018. This new study aims to provide a detailed overview of the state of the tourism real estate market in Marbella, as well as a “real map” of the situation, as defined by Muñoz.

“The aim is to implement measures within the Andalusian legislation to modulate and balance the tourist and residential use in the city,” explained the councilor at a press conference, adding that the results of the study will be integrated into the new General Urban Development Plan that is currently being drafted. The research, led by the Faculty of Tourism of the UMA and its University Institute for Research in Intelligence and Tourism Innovation, is expected to be completed by the end of the year or early 2025 and provide updated data on the economic and social impact of tourist housing in Marbella.

Muñoz acknowledged that Marbella has unique characteristics in its tourist-residential model, due to its large foreign population, whose period of residence is mainly between September and May. This circumstance allows that during the high summer season, many owners put their homes for holiday rental while they return to their countries of origin. This model, common in areas of high tourist influx, has worked for years without significant conflicts with the hotel industry, according to Muñoz.

Structural Factors in the Lack of Affordable Housing

Despite the City Council’s efforts to regulate the tourist housing market, experts and citizen groups argue that properties used for tourism are only one aspect of the housing access issue in Marbella and the Málaga province. Susana Gómez, Dean of the College of Architects of Málaga, believes that a lack of foresight and outdated urban planning have contributed to the current imbalance between housing supply and demand in the region. With general plans created over 20 years ago, Gómez explains, current modules and regulations are outdated and urgently need to be updated to facilitate the construction of larger homes.

“Housing has gone from being a basic necessity to a financial asset. When it shifts in this way, the problem begins,” argues Gómez, noting that this change has fueled the use of properties previously designated for residential markets as tourist accommodations. According to the Dean, Marbella is not the only city experiencing this shift, as similar trends have been observed in multiple tourist destinations in Spain and other European cities, where measures are being implemented to mitigate the effects of tourism pressure on housing markets.

The Bank of Spain, in its 2023 annual report, notes that vacation rentals have become a prominent topic in housing policy discussions, affecting the availability of long-term rental properties in areas like Marbella. The agency estimates that Spain will need about 600,000 additional homes by 2025 to balance supply and demand. Additionally, it mentions that vacation rentals account for approximately 10% of the rental market, a figure that has significantly increased in recent years due to rising tourism and rental platforms.

The Bank also highlights that areas with high concentrations of tourist housing tend to experience increases in purchase and rental prices, which contributes to the lack of access to primary housing in urban areas. Marbella, along with other coastal towns, is among the main urban areas with the highest density of tourist rentals. In these areas, the shortage of long-term rental options is driven not only by the rise in vacation rentals but also by the conversion of secondary homes into primary residences.

Citizen Demonstrations and Regulation of Tourist Housing Market

The pressure on the housing market in Málaga province has led thousands to demonstrate in the provincial capital, demanding solutions from local and regional administrations. Protesters are calling for effective regulation of the tourist housing market to ensure it does not become the sole accommodation option in the region, further hindering access to long-term housing.

According to the National Statistics Institute, Marbella ranks third nationwide in the number of tourist housing units, after Madrid and Barcelona. The high density of tourist properties in Marbella’s urban center and residential areas has driven up rental prices, making it difficult for many local residents to find affordable housing.

While the City Council awaits the results of a new study commissioned to UMA, the debate over the regulation of tourist housing continues to intensify. From the tourism sector, owners of vacation rentals insist that these properties should not be seen as the primary cause of the housing shortage and that their economic contributions benefit the city. However, both citizens and experts in urban planning and architecture advocate for a regulatory approach that limits the impact of these properties on the long-term housing market.

Antonio Guevara, Dean of UMA’s Faculty of Tourism, believes that regulation must be tailored to the uniqueness of each municipality. “The same rules cannot be applied in all cities because each model is different,” he explained. In the case of Marbella, where most tourist housing is located in areas of high demand from foreign visitors, the challenge is to balance the housing market without harming the town’s tourism appeal.

08. Analysis of housing in Spain and internationally according to the Bank of Spain

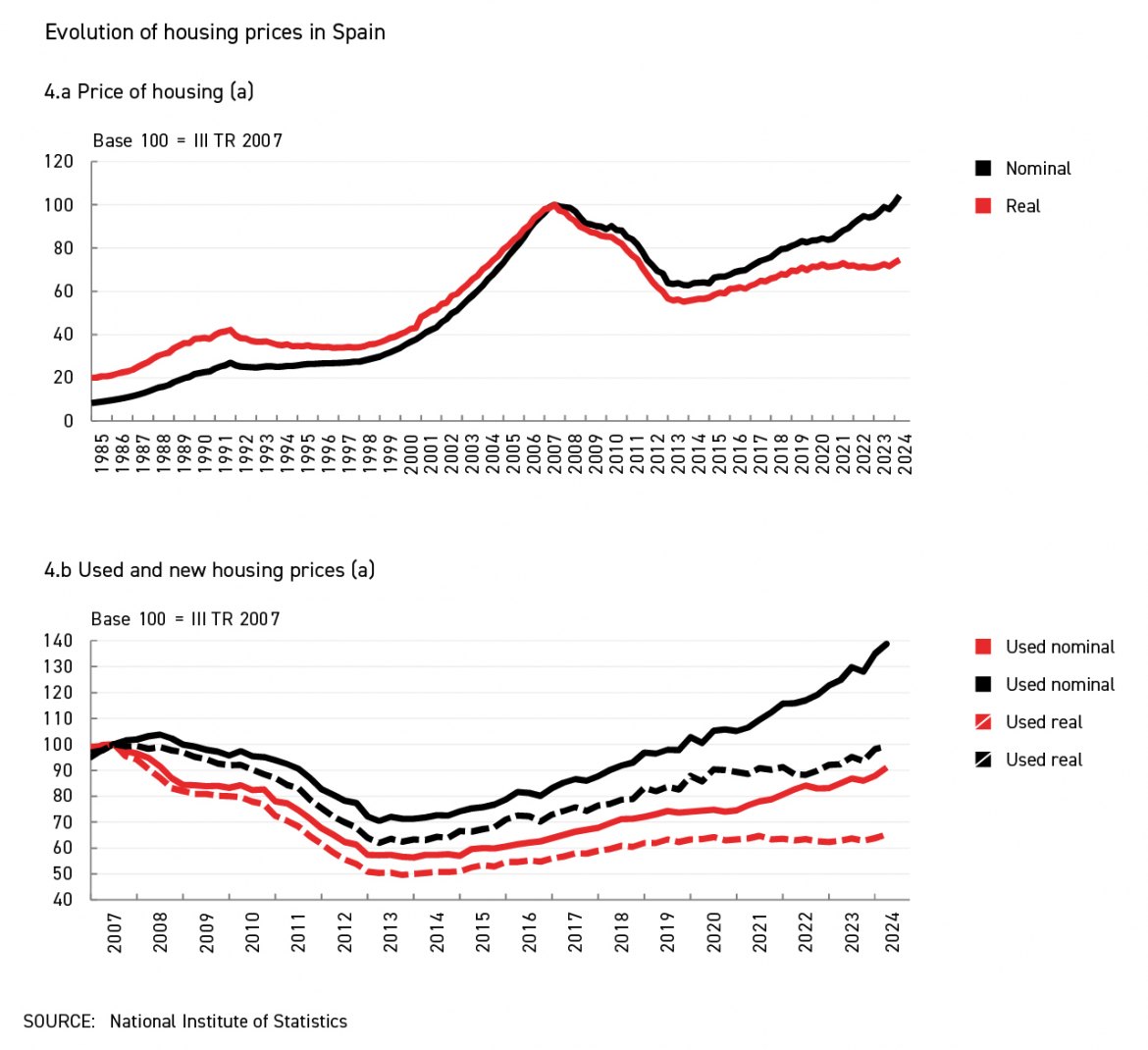

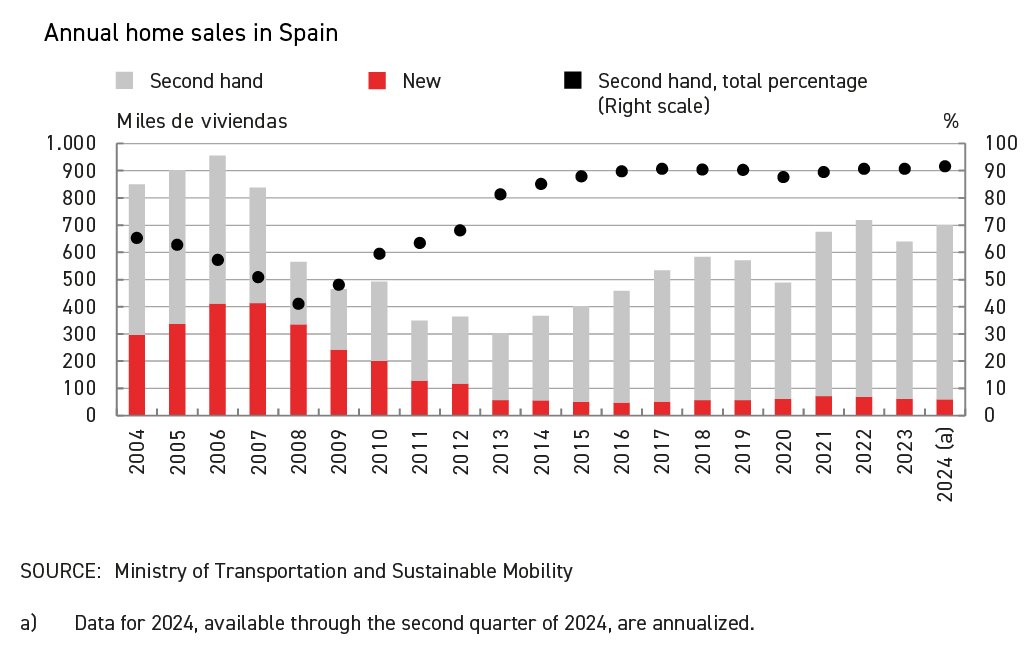

Recently, the Bank of Spain published its annual report THE RESIDENTIAL HOUSING MARKET IN SPAIN: RECENT DEVELOPMENTS AND INTERNATIONAL COMPARISON. This document highlights that Spain’s housing market has shown a remarkable ability to recover from the last financial crisis, largely driven by foreign demand, stable second-hand purchases, and limited new housing supply. However, several challenges persist, such as the need to balance supply and demand amid growing residential demand, persistent inflation, and limitations on new housing construction.

In the short term, Spain’s housing market is expected to continue its growth, although the gap between supply and demand may continue to narrow. Inflationary pressures and financing conditions will also play a determining role in the evolution of housing prices. To address these challenges, housing policies will need to adapt by incentivizing new housing construction and ensuring accessibility in an increasingly competitive market that remains attractive to foreign buyers.

The Evolution of the Residential Housing Market in Spain

Home sales have seen levels not observed since the real estate boom of the early 2000s since 2021 (see graph 1). Specifically, the annual average of home sales in the period 2021-2023 exceeded 675,000 units, with average volumes reaching 50,000 transactions per month. While the COVID-19 health crisis delayed home-buying decisions, contributing to the increase in transactions in 2021 and 2022, the dynamism of sales activity continued in 2023. For example, home sales in 2023 were 12% above 2019 levels despite demand constraints amid monetary tightening. This dynamism continues during the first half of 2024, with a transaction volume 21.5% above the transactions made in the same period of 2019.

Internationally, the Evolution of Residential Housing Construction Permits

Internationally, residential housing construction permits, which approximate the growth of new housing supply, have shown heterogeneous behavior in the main advanced economies over the past decade (see graph 16). A significant increase in housing supply has been observed since 2009 in Germany and Canada, where construction levels reached the highest levels in two decades in 2022. In the United States, housing production tripled from its low point in 2011 until mid-2022. However, since then, construction permits have fallen in most major advanced economies.

The impact of the 2021-2022 inflationary shock has eroded the appreciation of housing prices in real terms across the European Union. Specifically, while the cumulative increase in real terms from 2007 to late 2021 was 15%, this appreciation dropped to just 2.5% by early 2024 (see graph 19.b). This adjustment results from significant corrections in real housing prices across many large economies in the euro area. For instance, real housing prices declined by 21% in Germany, 12.5% in France, and 7.5% in Italy and the Netherlands from late 2021 to 2024.

Despite inflation’s impact, the outlook for next year is so positive that at the General Council of the Official Associations of Real Estate Agents of Spain held on October 25, renowned economist Gonzalo Bernardos highlighted, “The Spanish real estate market will experience a notable increase in sales for 2025, with a forecast of 825,000 homes sold, approaching 2007 levels.”

Bernardos attributed this upward trend to a situation of high accumulated demand, which he believes does not represent a bubble but rather a context similar to 2004 when the real estate market was in a growth phase. However, he noted that only 12% of these transactions will correspond to new housing due to the limited supply, creating a favorable scenario for those dedicated to buying and selling second-hand properties.

The effect on housing of the European Central Bank’s lowering of interest rates

The repeated lowering of interest rates by the European Central Bank (ECB) is putting the wind in the residential real estate sector’s sails. The month of September has corroborated the trend of recovery of home sales and purchases after the mortgage relaxation with a year-on-year increase of 12.5%, the sixth consecutive month in which the statistics are better than in 2023, according to data from the General Council of Notaries. On this occasion, 55,033 houses were transacted, marking the way for the 642,432 transactions signed last year to be surpassed by the end of the year.

At the moment, 515,000 homes have been transacted between January and September, 40,000 more than the 474,362 that were transacted at that point in 2023. A figure that makes the residential sector dream of approaching the level of sales and purchases achieved in 2022, when the sector uncorked the champagne to celebrate the best year since the outbreak of the brick crisis. At that time, 721,351 new and used homes were sold.

As was the case at that time, the growth in sales and purchases is now generalized throughout Spain. Only Navarra saw a drop in the number of transactions compared to September last year, after registering a 4% decrease. In other respects, there were more regions with advances above the national average than those below, being particularly relevant in the Basque Country (+39.8%) and Madrid (+24.5%), but no less meritorious in Castilla-La Mancha (+23.3%), Castilla y León (+21.9%), Asturias (+20.0%), Extremadura (+17.0%), Cantabria (+16%), La Rioja (+14%), Catalonia (+13.3%) and Murcia (+12.7%).

Galicia (+12.0%), the Balearic Islands (+6.2%), Andalusia (+4.9%), Valencia (+4.7%), Aragon (+4.5%) and the Canary Islands (+4.4%) also advanced in terms of the number of home purchases, although below the national average.

By type of housing, sales of apartments increased by 11.4% year-on-year, reaching 41,712 units, while single-family homes (villas) increased by 16.2%, to 13,321 units.

Mortgage recovery

That the relaxation of mortgage conditions has played a key role in the progress of the purchase and sale market is evidenced by the number of loans for home purchase, which grew twice as much as the number of transactions. In September, 25,794 mortgage loans were signed throughout Spain, 26% more than in the same month of 2023. This did not detract from the fact that home purchases with mortgages continue to be lower in proportion to those made in cash, representing 46.9% of the total in the ninth month of the year. In this type of acquisition with financing, the amount of the loan represented on average 72.2% of the price.